What Does “To Scale Up” Mean in Business?

What’s a scale-up business, technically? Well, it’s more than just a startup that’s gotten lucky. A scale-up is a company that’s figured out how to grow quickly—usually measured by a sustained annual growth rate (say 20% or more) over a few years—without completely collapsing under the weight of that growth. It’s not just about getting bigger; it’s about doing it efficiently with systems that can handle the added pressure.

So, what does scaling up really mean? It’s about creating a business that can handle more customers, markets, or operations without costs ballooning at the same rate. Think doubling your revenue but only slightly increasing your team size or overhead. Scaling is about multiplying impact, not chaos.

And the difference between scaling and growth? Growth is about getting bigger—more customers, more revenue, more staff—but often at an equal cost. Scaling, on the other hand, is growth that’s smart, sustainable, and efficient. Scaling is the difference between adding ten people to manage 1,000 new customers and finding a way to manage them with just one.

A key milestone before any of this? Product-market fit. Without it, scaling is a disaster waiting to happen. Product-market fit is your business’s way of saying, “Yes, people actually want what we’re selling, and we can deliver it at scale.” Without that foundation, scaling just amplifies inefficiencies and burns through cash faster.

There are plenty of complicated models for measuring growth and defining scale-ups, but let’s be real: they often miss the point. For me, an absolute growth rate over time—especially for companies already above a certain size—offers a much clearer, more actionable definition of what it means to be a scale-up. It’s simple, it’s measurable, and it reflects the realities of operating at scale.

What is a Scale-Up?

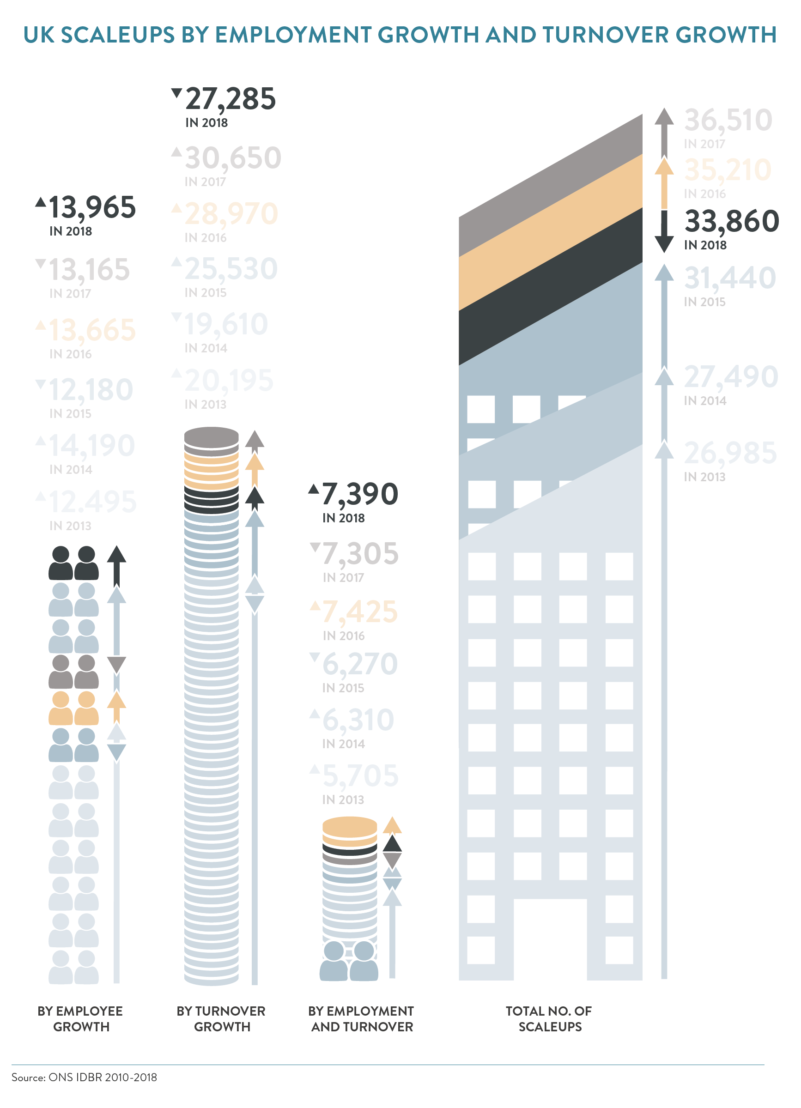

Let’s cut through the jargon: the OECD defines a scale-up as a company growing at 20% year over year for three years—whether that’s in revenue, headcount, or both. At the start of this scaling phase, the company should have at least 10 employees. In practical terms, for UK businesses, this means hitting around £1.2 million in annual revenue (assuming the average of £118,000 per employee for SMBs). The numbers give a useful benchmark, but the real challenge is sustaining that growth while managing risks and cash flow.

For context, Beauhurst tracks 30,000 scaling companies in the UK, and the ScaleUp Institute, alongside the ONS, continues to refine this data. But definitions are only part of the story. Scaling up is about smart financial planning, efficient resource allocation, and having the operational backbone to meet growing demand without breaking stride.

A Little History: Gazelles, Elephants, and Mice

Before the OECD started throwing out growth percentages, David Birch introduced the “Gazelle Company” idea in his 1987 book Job Creation in America. He argued that small businesses—especially gazelles—are the real MVPs of job creation. Gazelles, which he defined as fast-growing businesses, made up only 4% of all U.S. companies but were responsible for a staggering 70% of new jobs.

And what about the competition? Large corporations, aka “elephants,” couldn’t match this pace. Nor could the smaller, steady-state “mice” businesses. But here’s the catch: most gazelles hit growth plateaus around the five-year mark, where internal constraints often start rearing their ugly heads. Sustaining that blistering pace of growth is no small feat.

Gazelles Today

Fast-forward, and the term “gazelle” has evolved to mean any fast-growing company, not just small ones. While the tech sector grabs the headlines, gazelles are thriving in industries like food and beverage, retail, and fashion. What remains true is their importance as job-creation powerhouses—especially in entrepreneurial economies like the UK and USA.

Why Scaling Up Matters

At Monkhouse & Company, we’re all about unlocking the potential of entrepreneurship. The numbers speak for themselves: if just 200 UK firms scaled from 50 to 250+ employees, they’d create 300,000 jobs and add £52 billion in turnover to the economy (2014 Scale-Up Report by Sherry Coutu). That’s the transformative impact of scaling up done right—turning entrepreneurial energy into economic horsepower.

So, whether you’re chasing the gazelle model or aiming for a different kind of scale-up success, the key lies in balancing growth with strategy and having the resilience to keep moving forward.

A definition of scale-up

20% annual revenue or headcount growth for 3 years. Minimum annual revenue of £1m

The Rule of 40: Balancing Growth and Profitability

Verne Harnish, author of Scaling Up: How a Few Companies Make It…and Why the Rest Don’t, lays out a challenge for scaleups: aim for high-profit margins that rival the software industry—think 70% gross margins and 20% net margins. Ambitious? Definitely. But achievable for companies that know how to scale efficiently.

One key metric is the Rule of 40, borrowed from the tech world to evaluate high-growth, high-performance firms. The rule is simple:

Add your annual revenue growth rate to your profit margin. If the total is 40 or higher, you’re hitting the sweet spot.

This balance is crucial because it pushes businesses to invest in long-term growth while keeping an eye on short-term profitability. For example:

- A 30% growth rate with a 10% profit margin? Great.

- 15% growth but a 25% margin? Also solid.

The metric is flexible enough to work across industries, even though it’s rooted in tech.

While the Rule of 40 often uses EBITDA to measure profitability, other metrics like free cash flow or net profit might be better depending on the company’s context. Why? Because not every scaleup has the same financial structure, and some metrics paint a clearer picture of financial health and performance.

Ultimately, the Rule of 40 is about discipline—ensuring that rapid growth doesn’t come at the expense of profitability. Scaleups that can hit this benchmark often earn higher valuations and are better positioned to sustain their success. So, whether you’re growing fast or building steady profits, it’s a metric worth keeping on your dashboard.

A definition of scale up

Rule of 40: (annual revenue growth rate) + (EBITDA) should be ≥ 40

Growth vs. Scaling Up: A Tale of Two Journeys

Picture this: two ambitious B2B tech firms, both aiming for the stars.

- Growth Ltd. opts for a steady, predictable climb. They hire more employees, open new offices, and expand their marketing campaigns. Revenue rises, but so do expenses, step by step. It’s the classic “work harder, not smarter” approach—linear growth that feels like hiking up a mountain, one foot in front of the other.

- Scaling Stars, on the other hand, takes a smarter approach. They double down on automation, streamline operations, and build scalable systems. Revenue soars, but expenses stay flat. They’re riding a hot air balloon, achieving exponential growth with minimal additional resources.

What’s the key difference here? It all boils down to resources vs. results.

Growth vs. Scaling Up

| Aspect | Growth | Scaling Up |

|---|---|---|

| Progression | Linear: Revenue and expenses increase proportionally. | Exponential: Revenue grows faster than expenses. |

| Resource Use | Resource-intensive: Requires more inputs (staff, space, etc.). | Resource-efficient: Leverages technology and systems. |

| Speed | Steady but slow: Predictable, incremental gains. | Fast and transformative: Sudden, compounding growth. |

| Cost Impact | Expenses rise in line with revenue increases. | Expenses remain relatively stable despite growth. |

| Example | A bakery opens a second location, doubling its costs and capacity. | A SaaS company automates customer onboarding, increasing subscriptions without hiring more staff. |

Key Takeaway: Transitioning from Growth to Scaling Up

The goal for most businesses? Stop climbing and start soaring. Scaling up isn’t about avoiding growth; it’s about growing without breaking the bank. By making systems scalable—whether through automation, streamlined processes, or smarter resource allocation—you can handle increased demand without piling on costs.

Scaling isn’t always a straight line. There will be trial and error, a few bumps in the road, and moments where it feels like the ground is shifting under you. But the payoff? Immense. Businesses that figure out how to scale become more profitable, more efficient, and more resilient in the face of competition.

So, where’s your company headed? Are you on the linear path of Growth Ltd., or is it time to follow in the footsteps of Scaling Stars? The choice is yours—strap in for the journey!

How to Actually Scale (Not Just Get Bigger)

Stop calling it “scaling” when you’re just getting bigger. If revenue is up but unit economics aren’t improving, you’re not scaling — you’re piling on cost and calling it progress. The giveaway metric is simple: revenue growth paired with declining unit costs. No decline? No scale.

What this actually means in practice:

1. Decide What Game You’re In — Today

Growth mode: land-grab, distribution, awareness, speed. Accept some inefficiency.

Scale mode: same or faster top-line with structurally lower cost to serve. Engineer leverage into the model.

The difference between scaling up and growth isn’t just semantic—it’s operational. “Up and to the right” only matters if the steps get cheaper as you climb.

2. Track One Ruthless Dashboard

If you’re serious about scaling up your business, you need to obsess over:

- New revenue by segment/cohort

- Unit cost per customer/order/transaction

- Gross margin trend

- Cycle time (from demand to cash)

- Failure demand (rework, refunds, support tickets per unit)

If those unit costs aren’t bending down as volume rises, hit pause on “more” and fix “better”.

3. Split Your Roadmap: Growth Bets vs Scale Bets

Growth bets:

- Open 10 stores

- Add 5k users

- Launch in 3 new markets

Scale bets:

- Standardise planogram + automate replenishment so labour per store drops 15%

- In-product education to cut support contacts per user by 30%

- Centralise fulfillment to reduce cost per order by 25%

This distinction separates companies that scale successfully from those that just grow themselves into chaos.

4. Expect the Organisational Blast Radius

Common mistakes when scaling a business:

- Change fatigue

- Culture wobble

- Risk to customer experience

- The “process police” stifling innovation

All predictable side-effects. If you don’t name and stage-manage them, they’ll eat your margin before your new platform ever ships.

5. Use Imagination First, Analysis Second

Most teams try to spreadsheet their way to scale. Wrong way round. You won’t find the leverage point by drowning in data; you find it by seeing the business differently, then proving it fast.

The Quick Field Test Before You Commit Resources

“Huh.” Does your scale thesis reveal a non-obvious way of looking at the work? If not, you’ve got another backlog item, not a scale move.

“Ahh, got it.” Does it feel like a solution, not a goal? If it invites five follow-up “how?” questions, it’s not ready.

“Fuck yeah.” Does it energise the team to execute? Bloodless ideas die in delivery.

The Reality Check

Leaders love to blur growth and scale—often in the same sentence. Don’t. Toggle deliberately:

- Entering new markets? Prioritise growth.

- Traction achieved? Flip hard into scale: simplify, redesign, automate, and measure the hell out of unit costs until they fall.

That’s how you turn momentum into a durable advantage. If your weekly review doesn’t show revenue up and unit cost down, you’re not scaling—you’re just busy. Fix the model, then pour the fuel.

Side note

The term scaling up—used to describe the process of growing a company’s business model or organizational structure—is a bit of a linguistic mystery. No one’s entirely sure when it first entered the business lexicon, but before it became trendy to talk about scaling, these high-growth companies were charmingly called gazelles. A nod, perhaps, to their speed and agility. Of course, scaling has since become the cooler, sleeker term, leaving gazelles to the wildlife documentaries.

Written by business coach and CEO mentor Dominic Monkhouse, read more of his work here. Read his new book, Mind Your F**king Business here.